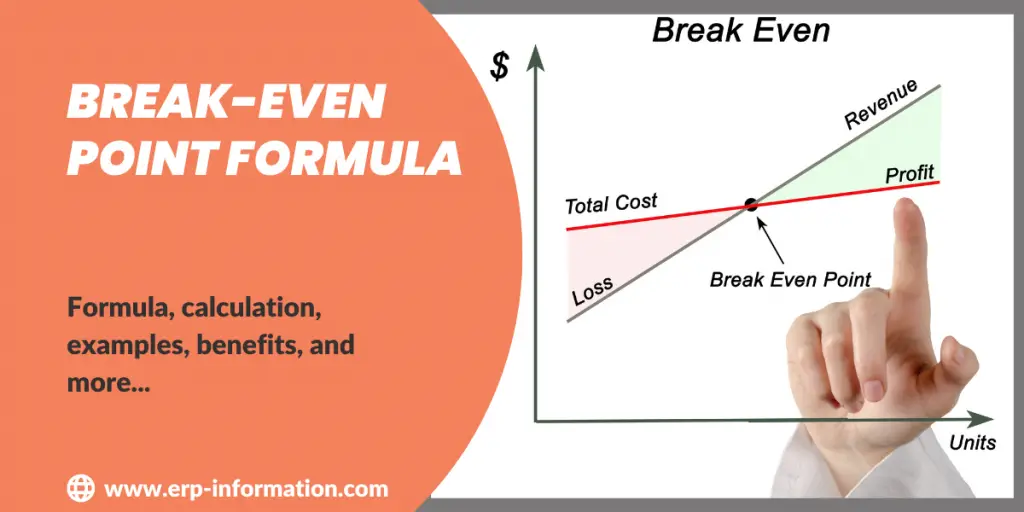

Do you need help finding the balance between your profits and losses? Knowing how to calculate break-even points is a crucial skill for any business. It can help you determine what sales revenue level will enable you to cover all your costs.

In this blog post, we’ll discuss the basics of the break-even point formula, analysis, and understanding the formula for calculating it.

We’ll also explore some case studies and scenarios that use this invaluable tool to make better financial decisions within businesses. No matter where you’re starting your journey toward becoming more financially informed, there is something here for everyone.

Evaluate the Break-even point using our Online Break-even Point Calculator

What is the break-even point?

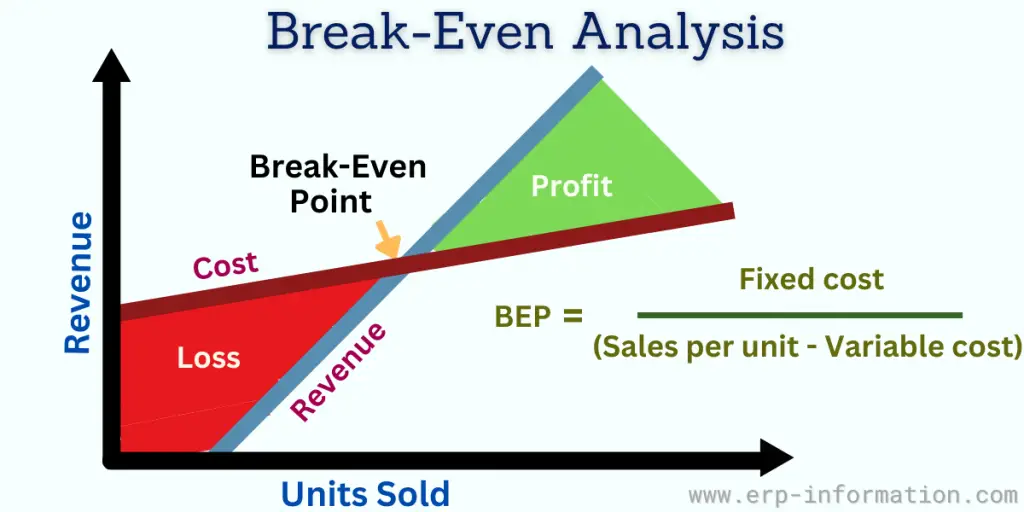

The break-even point is a crucial concept in business and finance that refers to the point at which total revenue equals total costs.

It represents the sales or production volume level at which a business neither makes a profit nor a loss. In other words, it is the point where the business breaks even.

To calculate the break-even point, consider fixed costs, variable costs, and the selling price per unit.

Fixed costs are payments that stay the same no matter how many things you make or sell. Examples of this are rent and salaries.

Variable costs, however, change depending on how many things you make or sell. Examples of variable costs are raw materials and labor.

Break-even point formula

The formula to calculate the break-even point in units is

Break-even Point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit)

Knowing the break-even point is important for businesses as it helps determine the minimum level of sales or production required to cover all costs and start generating profit.

It serves as a benchmark for decision-making, pricing strategies, and assessing the financial viability of a business venture.

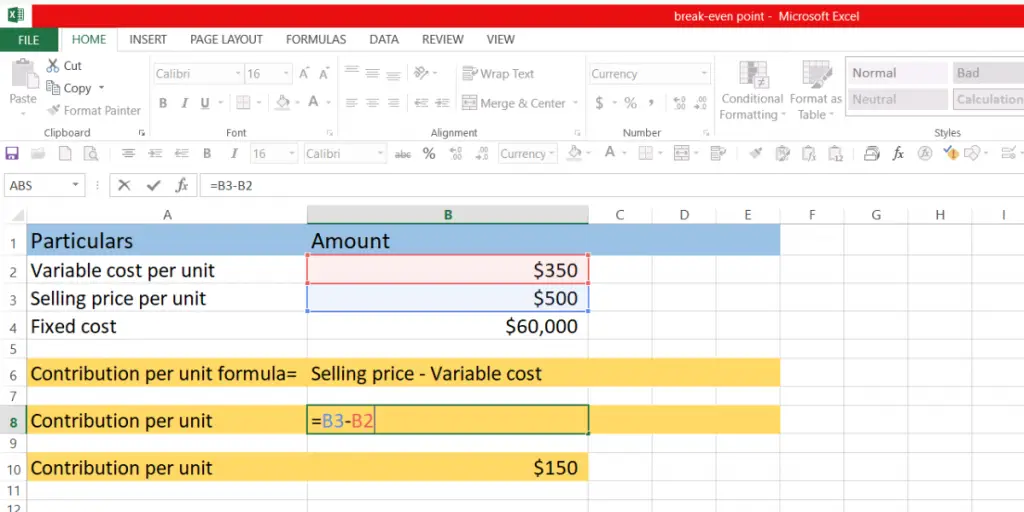

Examples

Assume that your company has a fixed cost of $60000, you sell your product for $500 per unit, and the variable cost is $350 per unit. The calculation will go as below.

The fixed cost is $60000

The sales price per unit is $500

The variable cost is $350 per unit

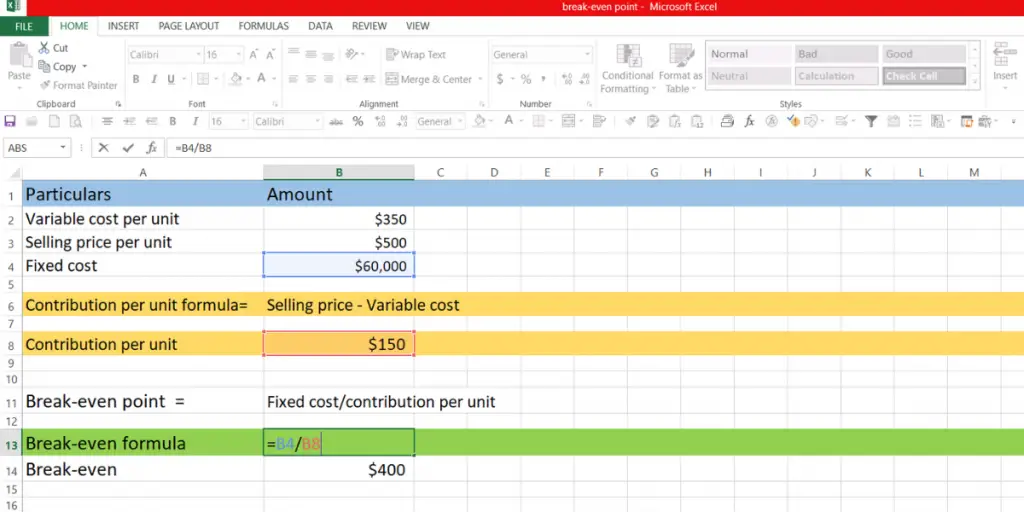

Now apply the formula

Break-even point in units = Fixed Costs ÷ (Sales price per unit – Variable costs per unit)

BEP = $60000/($500 – $350)

BEP = $60000/$150

Here, $150 is the contribution per unit cost.

BEP = 400 units

The break-even point in units is 400.

The break-even point in sales value = Fixed Costs ÷ {(Sales price per unit – Variable costs per unit)/ Sales price per unit}

Break-even point in sales value = $60000/ [($150/$500)]

= $60000/0.3

= $2,00,000

Example of a break-even point in the stock market

If you buy a stock for $500, the price must increase to make a profit. If it goes down below $500, you will have a loss. If it stays at $500, there will be no gain or loss – the breakeven point.

Example of breakeven point in call option trading

Options trading has a special point called the breakeven point. If you are buying a call option, the breakeven point is when the asset’s price equals the strike price plus what you paid.

Now, if you are buying a put option, it’s when the asset’s price is equal to the strike price minus what you paid. You will usually not have to pay any more fees, but if you want to include them in your calculations, you can.

An investor pays $5 for a Nestle stock call option. This provides them the right to buy 100 shares of Nestle at $200 each. The investor must pay $205 (the strike price plus the premium) to break even. If the stock trades for more than this, it can make money.

For example, if it’s trading for $220 per share, they can buy it for $200 and sell it for $220, making a profit of $15 per share.

Break-even point input option

An investor pays $4 for the right to sell 100 shares of Zee stock for $280 each until the options expire. The breakeven price is $276 (280 minus 4). If the stock is trading higher than that, then there will be no benefit from this option.

Analysis of breakeven point

A break-even analysis is a calculation that looks at how much money you put in and how much money you get out.

It tells you when the amount of money coming in will equal the amount going out. At that point, you won’t lose any money or make any profit.

Benefits of breakeven analysis

Helps to find the missing expenses

A break-even analysis can help estimate how much you have to spend. It can help you know what expenses to expect before they come up. That way, there won’t be any unexpected costs.

Useful to set the goals

A break-even analysis helps you determine how much money you need to make a profit. It will help you set goals and work hard to achieve them.

Business decisions on emotions

It is not usually a good idea to decide things with your emotions. A break-even analysis can help you make decisions based on facts instead of feelings. This is generally better for making business decisions.

Investor funding

When funding for your business, it is essential to provide investors with a break-even analysis. This analysis will outline your business plan and demonstrate how you intend to generate revenue.

Helps to decide the proper price

By utilizing this approach, you can effectively determine the optimal pricing strategy for your products. This will ensure that your business remains profitable and generates a steady stream of revenue.

Helps to assess the impact

This method helps assess the impact of cost changes or increases in production volume on their bottom line.

Moreover, by comparing the break-even point with actual sales, businesses can evaluate their profitability and make informed decisions regarding cost-cutting measures or growth strategies.

It’s important to note that the break-even point formula is a simplified calculation and does not consider other factors that may affect business performance, such as market demand, competition, and seasonality.

Therefore, it should be used with other financial and market analysis tools to understand the business’s financial health comprehensively.

FAQs

What are the factors that affect the breakeven point?

The common factors of BEP are an increase in variable cost or expenses, an increase in fixed cost or expenses, a decrease in selling price, and a different mix of products sold can also cause changes in the breakeven point.

How to avoid the breakeven point?

In order to avoid reaching a break-even point where you are not making much profit, you can follow these strategies:

* Spend less on things that cost the same every time.

* Look for ways to lower costs on items you buy regularly.

* Offer different types of products and consider raising prices, but make sure people still want to buy them.

By doing these things, businesses can keep their finances in good shape and stay away from the difficulties of a break-even point.

What is the negative breakeven point?

A negative break-even point occurs when a business incurs expenses that exceed its revenue, resulting in financial losses. In other words, the company is operating at a deficit. This circumstance typically arises when the business faces higher costs, such as rent and salaries, which surpass its income.

What are the limitations of the breakeven point?

The break-even point can have certain limitations that businesses should be aware of. Firstly, it assumes that all products are sold at the same price, which may not always be the case in reality.

Additionally, inaccuracies in calculating the break-even point can occur, leading to potential errors in decision-making.

Moreover, the break-even analysis relies on static costs, and if costs fluctuate frequently, it can render the analysis less reliable.

Variable costs, in particular, can vary significantly and impact the accuracy of the analysis. It is crucial for businesses to consider these factors when utilizing break-even analysis for pricing decisions.

Conclusion

In conclusion, the break-even point formula is a beneficial tool that helps to analyze and understand financial performance.

Businesses can make informed decisions about pricing, cost management, and profitability by calculating the break-even point, which represents the level of sales at which total costs are equal to total revenue.

Businesses can gain valuable insights into their cost structure, pricing strategies, and overall profitability by utilizing the break-even point formula as part of their financial analysis toolkit.

It empowers them to make data-driven decisions and confidently navigate the business landscape’s complexities.